Trump Tariffs Spark Surge in Investment Demand in the UAE

April 16, 2025 – Dubai

The recent imposition of tariffs by U.S. President Donald Trump has led to a notable increase in investment demand in the United Arab Emirates (UAE), particularly within its real estate sector. As global investors seek stable and lucrative alternatives amidst escalating trade tensions, the UAE’s investment landscape has emerged as a prime destination.

Also Read: How to Start a Coaching Business in Dubai

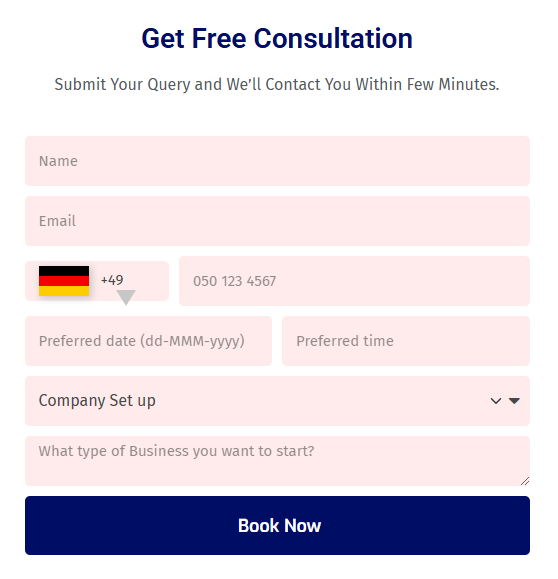

Check Out Our Easy Online Business Cost Calculator

Global Investors Pivot to the UAE

Trump’s announcement of a universal 10% tariff on all imports, including those from the UAE, has introduced significant volatility into global markets. This uncertainty has prompted investors to reassess their portfolios, with many redirecting funds towards more stable economies. The UAE, known for its investor-friendly policies and robust economic framework, has become an attractive option for these investors.

According to a recent report by Arabian Business, the depreciation of the U.S. dollar, a consequence of the new tariffs, has made UAE assets more appealing to foreign investors. The UAE dirham’s peg to the dollar means that as the dollar weakens, the dirham’s relative value decreases, making investments in the UAE more cost-effective for foreign investors. This dynamic has been particularly beneficial for the UAE’s real estate market, which is experiencing increased interest from investors in Europe, Russia, and India.

Real Estate Sector Sees Significant Uptick

Industry experts have observed a surge in demand for high-end properties in cities like Dubai and Abu Dhabi. Chris Whitehead, Managing Partner at Dubai Sotheby’s International Realty, noted that any drop in currency value tends to drive property demand in the UAE from overseas investors. Similarly, Angad Bedi, Chairman and Managing Director of BCD Group, highlighted that a softer UAE dirham, pegged to a weakening U.S. dollar, could make real estate assets in the UAE more attractive for overseas investors.

Broader Economic Implications

Beyond real estate, the UAE’s broader economy stands to benefit from this shift in global investment patterns. The country’s strategic location, coupled with its diversified economy and strong regulatory framework, positions it as a safe haven for investors seeking stability amidst global economic uncertainties.

Financial analysts suggest that the UAE’s proactive economic policies and commitment to maintaining an open market environment will continue to attract foreign capital. This influx of investment is expected to bolster various sectors, including tourism, technology, and finance, further solidifying the UAE’s status as a global investment hub.

As the ramifications of Trump’s tariffs unfold, the UAE’s strategic positioning and investor-friendly climate are proving advantageous. The increased investment demand underscores the country’s resilience and appeal in a rapidly changing global economic landscape.

Sources: Arabian Business, Khaleej Times, Gulf News

Also Read: Trade License in Dubai : Cost & Step Involved

Check Out Our Easy Online Business Cost Calculator

For more information, visit Alfa Zone.

You May Also Find This Article Useful: Starting Mobile Car Wash Business in Dubai: License & Cost Estimate

Tags:

Investment in the UAE, UAE foreign direct investment, UAE investment opportunities, UAE economy, UAE real estate investment, UAE financial markets, UAE investment strategy, Trump Tariffs, UAE Investment, Investment in the UAE, Global Trade Tensions, Foreign Direct Investment UAE, UAE Economy, Real Estate Investment UAE, UAE Property Market, Dubai Real Estate, Abu Dhabi Investment, UAE Stock Market, DFM Index, ADX Performance, Gulf Financial Markets, Investment Opportunities UAE, UAE-US Trade Relations, Middle East Trade Policies, Global Trade Dynamics, Tariff Implications, International Trade Agreements, Business Investment UAE, Investor Confidence UAE, Economic Diversification UAE, UAE Business Environment, Investment Strategies UAE, Gulf Cooperation Council, Middle East Economy, GCC Investments, UAE Economic Growth, Dubai Investment Trends, UAE Trade Policies, Economic Policy UAE, Regulatory Environment UAE, Investment Laws UAE, Trade Regulations Middle East

Comments are closed