Offshore Company Setup in UAE – Costs and Benefits

The United Arab Emirates (UAE) has emerged as a global hotspot for offshore company setup, attracting investors seeking tax-efficient corporate structures for international trade. In this comprehensive guide, we delve into the world of offshore company formation in the UAE, exploring its advantages, costs, and seamless process. We’ll also dissect the differences between offshore, mainland, and free zone companies, offering valuable insights into why offshore remains an enticing choice for savvy entrepreneurs.

What is an Offshore Company Setup in UAE?

An offshore company in the UAE is a tax-efficient corporate entity that enjoys several unique advantages. It’s legally tax-exempt, allows complete foreign ownership, eliminates the need for extensive accounting obligations, and grants the flexibility to open bank accounts both within and outside the country. This structure is particularly appealing for international trade.

Offshore Company vs Mainland Company vs Free Zone Company

Understanding the differences between these setups is crucial:

- Mainland Company Setup: Allows business activities within the UAE, with offices and employees based locally, and the option to apply for visas.

- Free Zone Company Setup: Offers 100% foreign ownership, tax exemptions, and simplified customs procedures but comes with limitations on conducting business outside the free zone.

- Offshore Company Setup: Designed for international trade and tax efficiency, an offshore company is registered in the UAE without the ability to operate business within the country. It doesn’t grant eligibility for UAE residency visas.

Read More: Exploring Business Setup in UAE: Mainland, Freezone, and Offshore

Offshore Company Setup in UAE: Saving Costs and Time

Setting up an offshore company in the UAE is remarkably quick and straightforward, especially with expert assistance. It offers numerous cost-saving advantages, including tax neutrality on international earnings and reduced legal obligations.

The cost of setting up an offshore company in the UAE is surprisingly reasonable, considering the substantial benefits it offers. It includes fees for license applications, documentation, and other administrative processes.

Commence the Formation of Your Offshore Company in UAE – Step by Step

Establishing an offshore company in UAE is a straightforward process, made even more accessible when working alongside a company formation specialist. The entire procedure can be finalized within a few weeks.

Here’s a step-by-step guide for an Offshore Company Setup in UAE, with the understanding that there might be slight variations:

- Choose Your Company Name: Begin by selecting a company name, which must undergo verification by the registrar. Ensure that the chosen name does not contain restricted terms such as insurance, bank, finance, and others. Additionally, it should include “Ltd.” or “Incorporated” at the end.

- Complete the Application: Collect the necessary documents required for the application process. These typically include attested passport copies of individual shareholders, proof of residency, the preferred company name, and details regarding the proposed business activities.

- Submit the Completed Application: Present the duly filled application form to the relevant authorities for their review.

- Draft a Memorandum of Association (MoA): The Memorandum and Articles of Association are provided in English and should be drafted accordingly.

- Commence Your Company: Once the MoA is prepared and all documents are reviewed and approved by the relevant authority, your company can officially commence its operations.

- Open an Offshore Bank Account: This step should be completed after the registration process is finalized.

Embarking on the journey of offshore company formation in the UAE is uncomplicated, especially with the assistance of experts in company formation. The entire process can be accomplished promptly, providing a hassle-free experience.

UAE Offshore Business Activities

Offshore companies in the UAE can engage in a wide range of business activities, such as international trading, holding assets, consulting services, and patent registration, as long as the activities are conducted outside the country.

Documents Required for an Offshore Company setup in UAE

To initiate the offshore company setup process, you’ll need essential documents, including passport copies, proof of residency, business plans, shareholders’ and directors’ details, and specific documentation based on your business activities.

To commence the establishment of a Dubai Offshore company, you will initially require the subsequent documents:

For individual shareholders:

- An authenticated copy of the owner/shareholder’s passport

- Proof of residency

- An original bank reference document

- Owner/shareholder particulars

- The preferred name for the forthcoming company

- The activities planned for the newly formed offshore company

- The hierarchical structure of beneficiaries

For corporate shareholders:

- A board resolution

- Memorandum of Association

- A parent company certificate indicating the names of shareholders/directors, duly attested

- The hierarchical structure of beneficiaries

More About Steps to Obtaining Your Trade License in Dubai, UAE

Advantages of Offshore Company Formation in the UAE

The advantages of establishing an offshore company in the UAE are compelling:

- Tax Benefits: Profits earned through offshore companies are tax-exempt in the UAE.

- 100% Foreign Ownership: Offshore companies allow complete foreign ownership.

- Confidentiality: Directors’ and shareholders’ information is not widely disclosed.

- Asset Protection: The UAE offers strong asset protection measures.

- Multi-Currency Banking: Offshore companies can open multi-currency bank accounts for seamless international transactions.

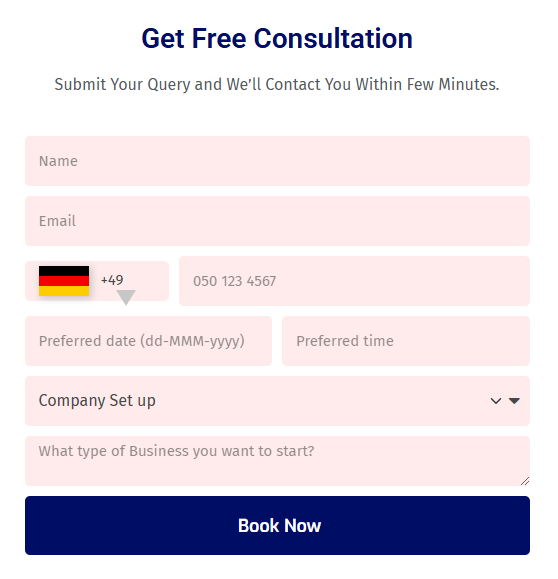

Why Choose Alfazone’s Services for Offshore Company Setup in UAE?

When it comes to offshore company formation in the UAE, Alfazone stands as a trusted partner. Our team of experts specializes in guiding aspiring business owners through the entire setup process, from license application to opening corporate bank accounts. We offer hassle-free, tax-efficient, and secure solutions tailored to your specific needs. With Alfazone, your offshore business will be up and running swiftly, allowing you to focus on your entrepreneurial vision.

Starting an offshore company in the UAE is an exciting venture that can bring significant financial benefits. With the right guidance and a clear understanding of the process, entrepreneurs can unlock the full potential of this thriving business environment.

Conclusion:

In conclusion, embarking on the journey of offshore company formation in the UAE is a strategic choice that offers entrepreneurs a wealth of advantages. From tax efficiencies to international market access and asset protection, the benefits are substantial. Understanding the distinctions between offshore, mainland, and free zone companies is crucial in making an informed decision.

While the prospect of setting up an offshore company in UAE is undoubtedly appealing, navigating the intricacies of this process requires expertise and guidance. This is where Alfazone shines as your trusted partner. With our professional services, you can streamline the setup process, save valuable time, and ensure compliance with all legal requirements.

Choosing Alfazone means choosing efficiency, security, and a hassle-free experience. We are committed to helping you unlock the full value of offshore company formation in the UAE. So, take the leap, harness the benefits, and let us guide you on your journey to offshore business success. Your thriving offshore company in the UAE awaits, and Alfazone is here to make it a reality.

Comments are closed